- #QUICKBOOKS FULL SERVICE PAYROLL PRICING SOFTWARE#

- #QUICKBOOKS FULL SERVICE PAYROLL PRICING CODE#

- #QUICKBOOKS FULL SERVICE PAYROLL PRICING PLUS#

- #QUICKBOOKS FULL SERVICE PAYROLL PRICING FREE#

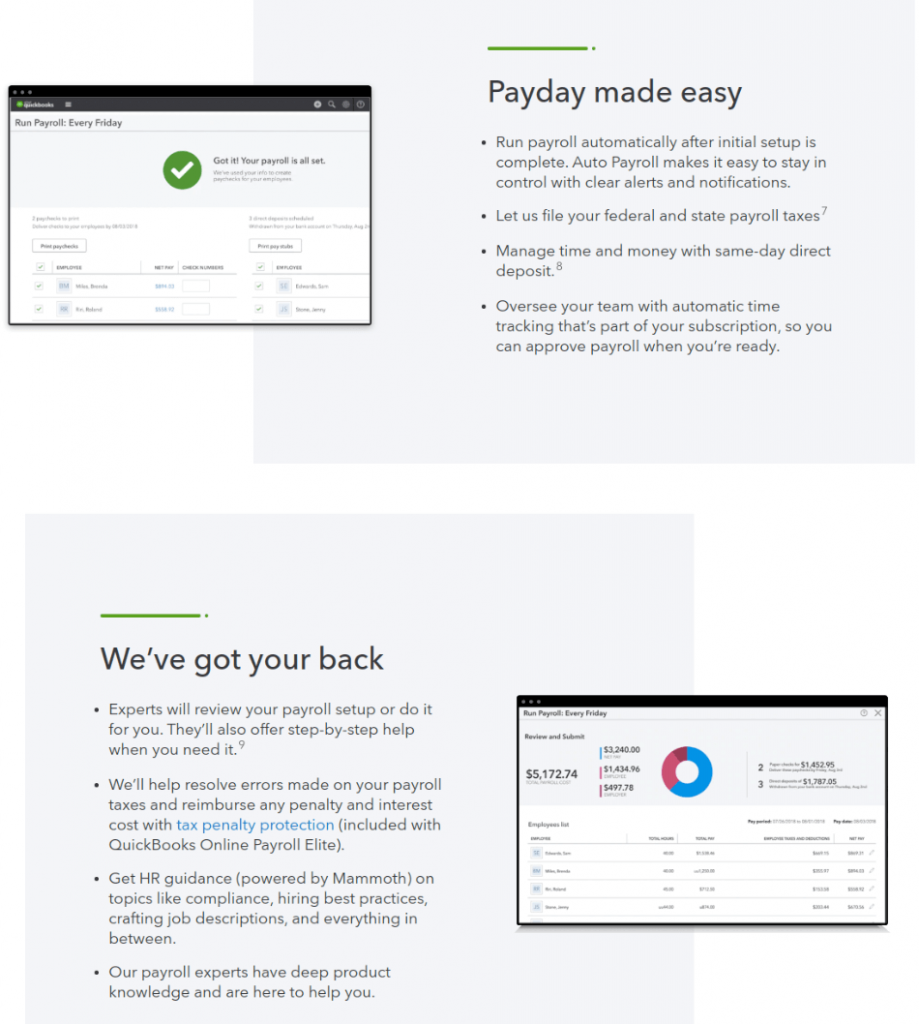

Plus, while other services charge a fee per payroll run, Intuit QuickBooks allows you to run payroll as often as you need at no extra cost.

With price points about on-par with Gusto and frequent discounts on their services, QuickBooks Payroll is one of the more affordable options on the market today.

#QUICKBOOKS FULL SERVICE PAYROLL PRICING SOFTWARE#

Folks who are already using QuickBooks Accounting software are able to integrate all their existing business data and tax information, making for a streamlined setup process. Intuit QuickBooks Payroll is nowhere near the most advanced provider in the industry, but much of its value comes from its convenience.

#QUICKBOOKS FULL SERVICE PAYROLL PRICING PLUS#

QuickBooks’ premium payroll package is perfect for any business with room in the budget for full-service payroll services and QuickBooks Plus Accounting software. Users can also file payroll taxes, record expenses, create invoices, track employee vacation time, track invoice status, and manage unpaid bills and their payment plans.Who is Full Service Payroll + QuickBooks Plus Right For? The Enhanced version allows the management of finance and related activities such as payroll in one place. This helps improve compliance, avoid fines and penalties, eliminate double entry, and aid the timely completion of tax reports. Additional functions include calculating employee compensation, customization of invoices, regulations of labour law posters, sales tax management, contractor and employee management, inventory tracking and bookkeeping functions.

#QUICKBOOKS FULL SERVICE PAYROLL PRICING FREE#

It fully automates the filing of state and federal tax payroll forms, offers free payroll support, handles electronic tax payment and filing of tax forms, and free direct deposit. This is a payroll management software that handles the timely and easy creation and payment of employee/contractor cheques and the calculation of federal and state tax payments. QuickBooks Desktop Basic Payroll Software QuickBooks Desktop Payroll offers three versions for small businesses the Basic, the Enhanced, and the Full Service. QuickBooks scrutinizes tax reports on tax management issues to resolve errors regarding interests rate and penalty charges automatically.

#QUICKBOOKS FULL SERVICE PAYROLL PRICING CODE#

Other inclusive areas are employee dress code monitoring, commission and vacation policies, and handbook customization. The software also helps to manage operations such as the hiring process and compliance management. The software allows for in-house management of onboarding employees, attendance tracking, and compensation and benefit calculation. The payroll version of QuickBooks Desktop offers employee and human resource management services.

The desktop version of QuickBooks provides a time-saving feature in business management by providing unlimited software updates and support, tracking daily activities, and improving invoices and stock management visibility. QuickBooks Desktop is an accounting software locally installed on a desktop or computer to manage daily businesses relating to bank accounts, suppliers, and customers. QuickBooks is designed by Intuit and offers many versions on-premise and off-premise. These business operations cover robust accounting solutions such as the customization of invoices, cash flow tracking, creation and analysis of the business report and payroll functions.Īccording to a 2019 research by Intuit Investor Day and Statista, the software, serving over 200,000 mid-market customers, is a financial management software used by 64.4 per cent of small businesses.

0 kommentar(er)

0 kommentar(er)